There’s been a trend lately across TikTok, and generally in real life… watching strangers and peers disclose their salaries, rent and spending habits. Sometimes it’s during a piece-to-camera. In other instances, it’s to a literal stranger on the street with a microphone and an iPhone. It’s become a nightly ritual — part financial voyeurism, part self-soothing, going down a rabbit hole of these (particularly the ones where fabulous NYC residents share their apartments, and their eye-watering rent). In a world where financial security feels more elusive than ever before, peeking into someone else’s wallet can offer a strange sense of comfort.

When I was growing up, money was a topic we danced around. It was considered impolite to discuss, almost taboo. There is an empowerment to the transparency, especially because when I started in the PR industry, we never dared to speak about salaries in the office, and even asking for a 5% bump felt wrong… like I was showing that I wasn’t grateful to be there. And truly, good riddance to the toxicity of that, I couldn’t be more happy that kind of behaviour is now just a millennial fever dream (and ongoing therapy theme for many, I’m sure). But as financial transparency becomes more and more the norm, it can also be dangerous, because no one ever has a full picture.

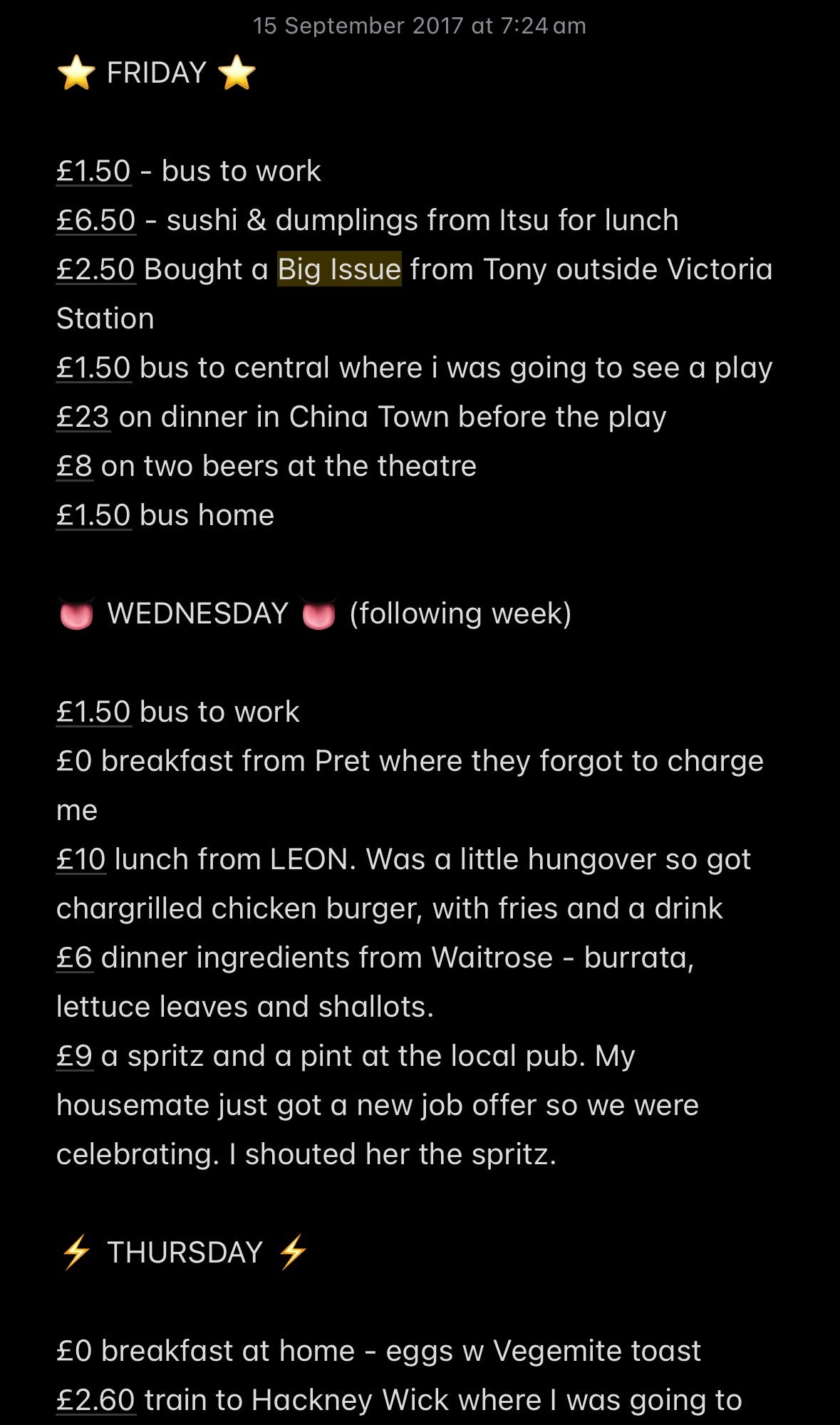

Back when I lived in London, I was OBSESSED with Money Diaries, a feature each week on Refinery29 UK where you could read through a week in someone’s life, as told through their bank account. The anonymous subject would list their job title, their salary, and then list day by day what they did and how much they spent. It was addictive. I even submitted myself for it, and started documenting my own Money Diary in the hopes I would get chosen. It felt like Monopoly! I never did get chosen, but I still have the screenshots of the notes when I was tracking my spending (a hilarious walk down memory lane…).

The biggest part of this feature? The anonymity. It’s crazy to think how far we have come from then, where you never would have submitted yourself for this kind of profile if you had to put your face and name to it, to now… in an era where financial transparency is not only accepted, but almost celebrated. Platforms like Glassdoor cracked open the salary secrecy, and now social media has turned financial disclosure into a cultural phenomenon.

I remember discussing a salary as off-limits, but now, it’s apparently content. Creators are sharing budgeting breakdowns, rent disclosures, and investment strategies, turning personal finance into a collective experience. It's empowering, sure, but also a bit overwhelming. I still remember the first time I learned a colleague earned significantly more than me for a similar role. It was a mix of shock and validation. That knowledge propelled me to negotiate better, and to understand my worth. But it also introduced a new layer of comparison and self-doubt, when I didn’t have the whole picture of why they might have been earning more. I was comparing apples with apples, when in fact, it might as well have been apples and potato. It was a hard lesson to learn when I approached my manager with the concept that we were the same, only to learn of so many things that made us, well not so much the same. In fact, I learned quickly that I needed to pull my socks up quickly if I wanted to have a seat at that table again.

Of course the rise of financial transparency has its merits. It demystifies money, fosters community, and encourages informed decision-making and financial literacy (all great things!). But it also opens the door to comparison traps and financial anxiety. Not all disclosures are created equal — some omit the privileges that cushion their financial choices, painting an incomplete picture.

As someone who runs a small business, I see the allure of curated financial narratives. They’re compelling, relatable, and, at times, aspirational. But they can also be misleading. It's essential to approach these stories with a critical eye, recognising the nuances behind the numbers.

In the end, our obsession with each other's money reflects a deeper desire for control and understanding in an unpredictable economic landscape. Transparency can be a tool for empowerment, but only if we use it wisely, balancing curiousity with compassion, for others and ourselves.

Kinda obsessed with watching…

The TikTok accounts or hashtags I love to scroll through when it comes to spiralling out about how much money other people have:

@salarytransparentstreet – Founded by Hannah Williams, this account features street interviews where individuals disclose their jobs and salaries, promoting open discussions about income.

#paydayroutine – Creators share their payday routines, detailing how they allocate their income towards expenses, savings, and investments.

@calebwsimpson – He’s the guy that asks people how much rent they pay in New York City, and then asks them for a tour of their homes. We all know and love him. Very much staged, and very much bingeable.

Kinda obsessed with purchasing…

I’m planning a bedroom re-do. We have no money at the moment (lol - the irony) but here’s what I would be buying if we did (and what I hope to have in my bedroom soon… ish):

The Cindy striped lamp from Fenton & Fenton (currently on sale, and so I almost pulled the trigger… until I realised I am far too impatient to wait for October deliveries).

This linen set from Sage and Clare… and I have a smattering of other patterns for under sheets and cushions I want to pair with it. I just need that dopamine hit first thing in the morning, yknow.

Sarah Ellison bedside table… I love that it looks like chubby little legs AND it has a drawer for me to hide all my mess in.

This amazing porcelain piece from Sam Lewis Wards… Allens pineapples are my fave lollies (do not come for me because I will not argue with anyone about this), and I would love this as a feature piece on our wall. Like I said, DOPAMINE!

I’m a candle slut (seriously, it’s actually doing damage to my bank account), and always need a freshie in my bedroom. I’ve been wanting to try Troye Sivan’s Tsu Lange Yor range for so long, but keep going back to Celia Loves for the pure affordability. I might treat myself to this bad boy next pay cheque.

Kinda obsessed with reading…

Just your publicist fan girl coming through with her fave celebrity profiles recently. These ones are from three rising stars (ok, I think Sydney is probably not so much rising, so much as risen, now)… but Milly and Addison are having their moment in the sun with her currently, and so I loved all of these for different reasons:

Addison Rae for the New York Times — unpacking the internet girl to popstar pipeline, and she’s in on the joke.

Milly Alcock for ELLE Australia – still reckoning with imposter syndrome, even in a cape.

Sydney Sweeney for The Sunday Times Magazine — fiercely ambitious and done apologising for it.

that’s it from me this week.

If you’ve ever fallen asleep with a “what I spend in a week” video still playing, or sent a salary reveal TikTok to your group chat with 17 exclamation marks… I see you. Money talk used to be taboo. But now, it’s apparently empowering, addictive, sometimes a little deranged, and quite frankly, I am finding it really quite overwhelming. I guess it’s just another part of the new normal of oversharing on social media I am learning how to navigate.

Please reply and tell me the last money convo that actually changed how you think. I’d love to take it to some dinner party tables soon.

And please, if you find out what your ex or your arch enemy earns, do not tell me. I’m trying to heal.

—

If you’ve not yet subscribed for the newsletter, i’d love if you’d consider doing so. you can also forward it to a friend, share it on your IG story or text it to your family—whatever moves you to do to support me if you feel so inclined. growing this space is really important to me, and if you enjoy what you read here, it would mean a lot to me if you’d share it with a friend you think might also enjoy it.

I want that lamp omg